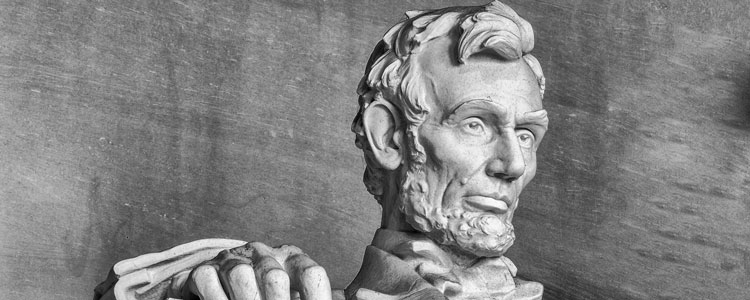

Did you know that Abraham Lincoln paid income taxes throughout the Civil War, but after his death, Treasury returned all his payments? Here’s the story…..

The Civil War prompted Congress to enact the first income taxes in U.S. history.

After considering various alternatives, Congress included a comprehensive income tax in the Revenue Act of 1862. There was a special 3 percent tax on the salaries of every person in the “civil, military, naval, or other employment of the United States.”

Lawmakers took pains to include themselves in the new levy, specifying that the tax applied to senators,

representatives, and delegates in Congress. Constituents were apparently happy to see their representatives paying up. Thus, the President was paying $61 monthly, or 3 percent of his $25,000 salary, minus a $600 exemption.

However not everyone agreed with this new law. In 1863, Chief Justice Roger Taney wrote in protest: “The act in question, as you interpret it, diminishes the compensation of every judge three percent, and if it can be diminished to that extent by the name of a tax, it may in the same way be reduced from time to time at the pleasure of the legislature.”

He felt he needed protection from a grasping Congress, which might be inclined to starve judges into submission, insisted Taney. Years later, it was determined that the taxation of judicial salaries and the President, did have constitutional protection. On April 25, 1872, the administrator of Lincoln’s estate filed for a refund of taxes, a total of $3,556.

Can you image what the Chief Justice would think now? It was only 3% back then, now it would be about 30% with the chance of Alternative Minimum Tax added on and State income taxes as well.

Mary Guldan-Lindstrom